I think you're missing that someone gave them money at some point, usually their parents.

Memes

Memes! A way of describing cultural information being shared. An element of a culture or system of behavior that may be considered to be passed from one individual to another by nongenetic means, especially imitation.

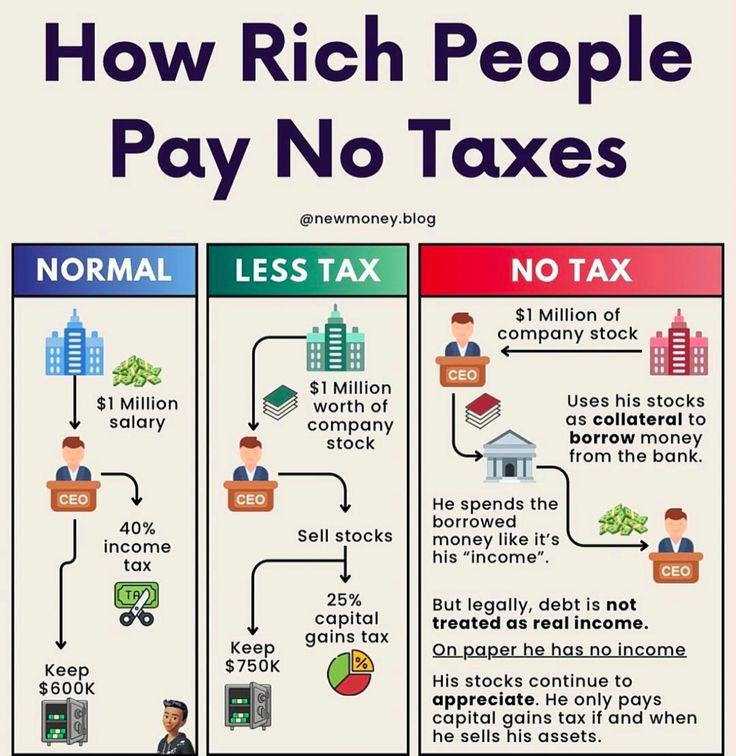

Yeah and then they evade taxes

That's usually how they evade taxes.

Are they successful or corrupt/nepo baby?

The right most one there is a problem. Feels like people shouldn't be allowed to do that, but I don't know the best mechanism to make it illegal.

The whole concept of interest is fucked up and a tool for the rich to extract money from the poor. That should be illegal.

I'm pretty sure it used to be considered bad and sinful

https://en.m.wikipedia.org/wiki/Usury

In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal

bad and sinful

Lpt: you can use the Bible as an excuse to not push credit cards on customers in retail.

Deuteronomy 23:19 is quite clear when it says “You are not to charge interest to your countrymen: interest on money, food, or anything that may be loaned on interest"

Banks charge interest on credit cards.

If I push a credit card, that is the same as me pushing interest on my fellow countryman, and as I am a devout Christian (lmao no, I have donated money to TST to help pay for their clinics) I cannot in good conscience offer a credit card to anyone.

So far no retail manager has pushed back on it. Probably because they know I'm full of shit but if pressed I absolutely will make it a problem for them, and since I'm solidly in the Bible belt of the US (send help please), nobody wants to chance a court case.

Interest payments from money sitting in a bank account are basically a rounding error on most rich people’s balance sheets. By far the most wealth they accumulate comes from the growth of stocks they own.

Yes, but that wealth will tie one way or another into the banking system (for example a rich person could take an ultra low-interest loan to invest it), which is fueled by money extracted from working class people by restricting necessities of life such as housing and education. I mean banks certainly aren't building up their wealth by giving loans to the rich essentially for free. It's no exaggeration to say that the whole system runs on human suffering with the purpose of making the rich richer.

Stocks as compensation are taxed as income.

My retirement is going to take 30 years to make it where it needs to be at 8% buuuut the rich get to avoid 37% tax annually.

Tax avoidance*

Yes. Tax evasion is a crime. Tax avoidance is paying only the taxes you’re legally required to pay.

If you’re going to blame someone, blame the legislators who created really complicated tax codes with a million different exemptions, loopholes, carveouts, and rebates. Very simple tax systems don’t have these issues so no one ends up paying more than they owe.

It's both

mostly avoidance, specially because they are typically smart enough (or more accurately their accountants are) to realize that going to court with the feds is expensive and paying the minimum amount of tax (and accompanying shenanigans to reduce taxable income) is much cheaper.

Couldn't be more wrong, if it tried.