this post was submitted on 05 Jan 2024

1069 points (95.9% liked)

memes

17550 readers

3358 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads/AI Slop

No advertisements or spam. This is an instance rule and the only way to live. We also consider AI slop to be spam in this community and is subject to removal.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

How about we stop spending so much money. The US is already in $36 Trillion dollars of dept.

What if I were to tell you that one of the points of a UBI is to replace welfare programs?

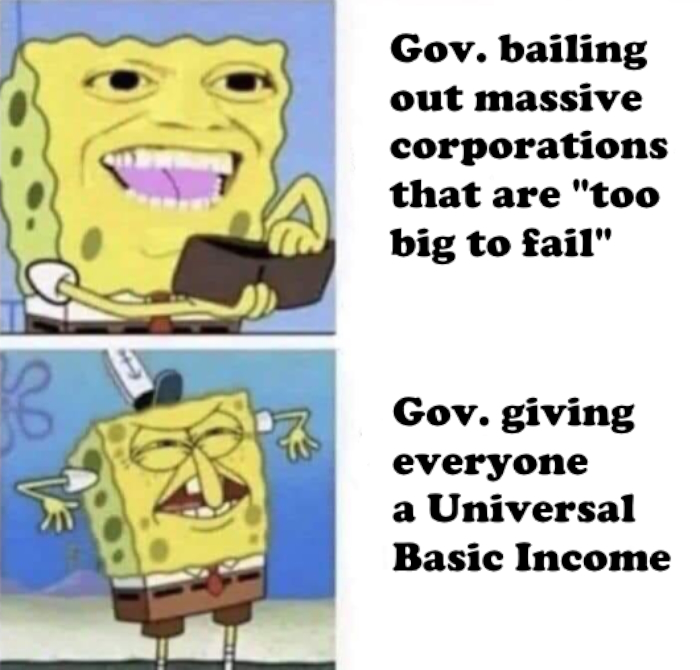

A "universal basic income" shouldn't be a thing. It encourages laziness and is more government spending which can worsen inflation.

Welfare for corps is cool though

As long as it isn't forced

Other than all the proof from places that have tried pilot programs that it actually improves productivity, and the fact that government spending only increases inflation if they're, you know, making inflation with a money printer.

Anything else you feel like being wrong about today?

People have said, "the U.S. is already ___ dollars of debt" my entire 46 years as if that means something. What does it mean? Sometimes the economy goes up, sometimes the economy goes down. Debt keeps going up. It doesn't seem to be changing anything.

That debt means nothing on its own. Correctly managed debt is a great way to earn a lot of money.

Government debt is not the same as individual or corporate debt. Most of the US's debt comes in the form of issuing Treasury Bonds, and most of the debt is owed to the American people. The US also controls its own money supply in which that debt is denominated.

Also, spending is only part of why debt goes up. A huge portion of the US debt has been created through tax cuts, e.g. the $1.5 trillion Ryan-Trump tax cut for high earners early in Trump's presidency

Who cares if most of it is owned to rich Americans. If anything it is all worse because you are creating a totally non-thinking investment, an easy way for the rich to keep their money instead of them trying stuff like starting new ventures. Ever heard of the crowding out effect?

Yes the US controls its own money supply in very vague sense of the word "control". If the fed tried printing it's way out of debt inflation would cause collapse.

You really like the black and white arguments, don't you?

Controlling a source of money doesn't mean the only option is to print so much of it that inflation eats the whole economy.

Let me ask you this: if the US is so bad at managing the debt it owes to its people, how come we have functioned as an economy under that debt for the last several decades?

And you really like downplaying how shit things are.

Let me ask you this: if smoking or being overweight is so bad for your health how come people can do it/be for several decades?

Got it? No? Alright let me break it down. Most of the debt we have was built up starting from 2001. A combination of two wars, tax cuts, defunding the IRS, and bailouts. So it isn't several decades it's 2.5. Now in that time period there have been 3 government shutdowns or 1 per 7 years. The current debt to collections ratio is second highest of a nation in the world and every other (ok not Japan) government hovering around that ratio owes money to the IMF which is another way of saying it is easy to erase.

The types of debt the US carries is far from simple with 10s of millions of individual creditors. And unlike Japan the high debts were accumulated in infrastructure, it was not for war or to give the wealthy a tax break. If the Japanese default they will still have their highways, if we default we still can take comfort in turning Iraq into a smouldering pile of rubble.

Our debt is huge, new, complex, and we have nothing to show for it. As long as it remains it grows faster than tax revenues grow to service it. Which means our government runs less efficiently. This is real dollars and cents. Projects don't happen, food stamps don't go out, roads don't get repaired and all the while more and more money is transferred via income taxes to people who are already wealthy enough to buy our debt. Meanwhile the typical ways of getting out of debt remain out of reach. We can't print money without inflation, we can't get it forgiven because we don't have one single major creditor, we can't raise taxes because that would be unpopular, and we can't cut anything without sending chaos out there.

But I forgot, since we aren't immediately in risk of dying we have no risk of it. Have you considered a career in insurance?

^ did not read past the question. Guarantee it's alarmist garbage about how we're definitely going to die because of some imaginary numbers were living fine with.

Hey man, get off your high horse a little and I might start taking you seriously.

Yeah reading doesn't seem to be your thing

It's not hard to clock a thesis as wrong and ignore the rest of the essay. Pretty arrogant of you to assume the problem is me.

Either way, have fun yelling at people on the internet how wrong they are about something abstract and purely theoretical.