What is the size of the “median” home in each area? Single family, or townhome, or condo?

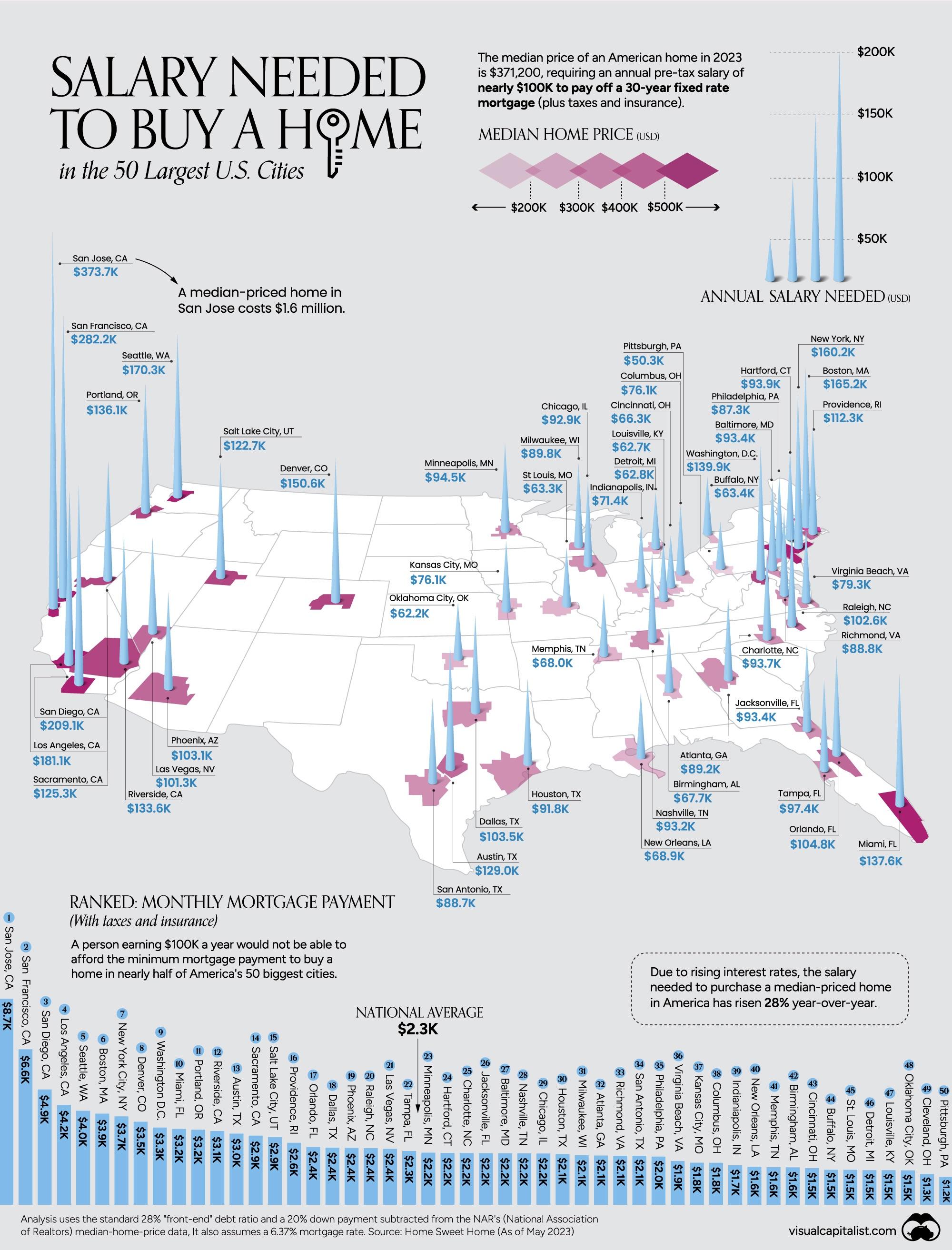

Given that this appears to be a median average, this graphic does not account for the extremely wide variance depending on the cases above. A two bedroom condo and a five bedroom single family home could easily have a $2000/mo variance in the mortgage cost.

The other item that would perhaps be useful would be to call out what the down payment requirement is for each of these areas; ie, you can only achieve a $3000/mo mortgage if you’ve also put down $140,000, which is unachievable for over 90% of the country.