Even less people are buying homes, but prices won't drop and mortgage are rising. Great. Seems like a healthy system.

And such a sustainable one too! But hey, waiting for your parents to die so you can inherit their house is still achievable by many people!

Don’t worry they’ll downsize or sell long before that

Only if their retirement savings run out and they have to rely on Social Security. But really, what are the odds that will happen?

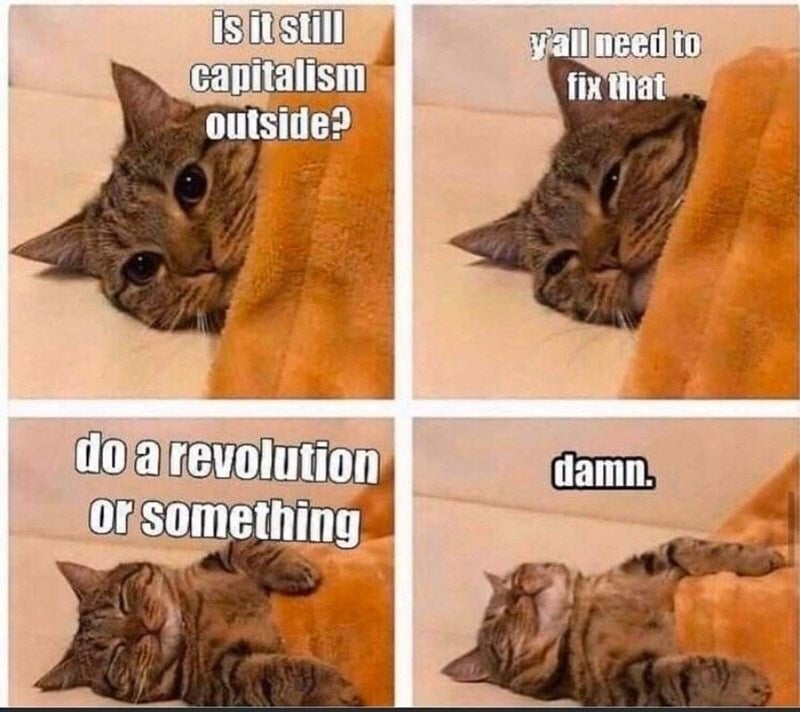

The revolution would have to be pretty much global at this point. I don't have much hope for that.

The Arab Spring called... but the line got cut off and I'm pretty sure they got beaten to death.

So.... yeah.

Assuming they haven't cut social security by then to.

Not if you never moved out.

I mean… it happens like this at the end of every credit cycle.

The most desperate sellers take price cuts. Prices slowly come down a teeny bit while inflation eats away at the affordability problem and rates gradually fall back down.

In 3 years the market will be healthy again.

We bought a home in 2018. Not huge, but still a 3 bedroom with a big yard for the dogs to run around in and in a safe and relatively affluent neighborhood. The mortgage is a 3-point-something percent fixed-rate APR. We don't like living in this town. We would love to move. But we couldn't possibly afford a mortgage at the rates they have them now. The house is in my wife's name because she has impeccable credit. The idea that she would even be considered for a fixed-rate APR mortgage at this point is risible.

By the way, this was the first home we ever owned. My wife and I are the same age. We were 41 when we bought that house and it was pretty much the cheapest house in the neighborhood in a town that isn't especially desirable and a depressed community with not a huge number of jobs. Back in 2018 before all of this really got ridiculous.

People younger than us? No fucking chance.

Am 35. Looking. Friend just closed.

It's awful. It's hard to walk away from my rental right now, all things considered.

The good news is that price homes are finally coming down. Not much, but folks entering the market with a 250k home asking 400k are going down to about 375k right now.

It's a start...

Yeah we are looking in NH to move out of Florida and closer to family, but going from $775k to $749,999 isn't a huge help. Hope the trend continues.

In the same boat. 38 and wanted to buy a house, riiight when COVID started. So waited so we didn't die, then prices shot up so waited for them to go down, but they didn't and rates are now too high to even consider. And no one can really sell because of what you said.

So if the government wanted to be sure no one could get a loan and the only people able to buy houses were corporations with cash on hand...good job government?

Corporations, for the most part, seem to be shirking the interest rates too! The minute they come down it's going to be a feeding frenzy..

Are you me? Seriously though, we're in an almost identical situation. How are people supposed to buy homes under these conditions? Prices are insane, rates are sky high. Our home value on paper went through the roof but we're never gonna see any of the value because we're basically stuck. The only effect the value increase has is that we pay more property tax. I can't imagine the difficulty younger millennials and Gen z are going to have getting a home.

oh thank goodness we're no longer in a financial crisis. Im sure people not having homes shouldnt be a metric for what constitutes one. As long as the rich people are still making money.

They really buried the lede on this one. Tight supply and high mortgage rates is leaving a lot of pent up demand. We can keep hoping for a correction, but I'm not being on one quite yet.

There is no supply because private equity is buying so many homes

But they're still building.... 650ft² "luxury" condos for $2600/mo. Utilities and renting shitty "common room" all extra of course.

What's the actual data on this?

I'm sure PE is buying some homes, but that's a different statement from the much stronger claim that they're buying so many that they're directly creating a shortage.

Here's some data I found.

Many factors have influenced this unusual market, of course. But one that affects the housing shortage in particular is institutional real estate investment. Institutional investors purchased 13.2 percent of all properties sold in 2021, according to a 2022 report by the National Association of Realtors (NAR). Perhaps more concerning is the fact that they bought those homes for 26 percent lower than the state median prices during that period.

These large investment companies are exacerbating the home-inventory shortage by buying up the most affordable properties and renting them out, making it even harder for individuals and families, especially first-time homebuyers, to get themselves onto the housing ladder. Source

Industry advocates argue that they do not control enough market share to dictate prices in any market. Large institutions owned roughly 5% of the 14 million single-family rentals nationally in early 2022, according to analysts.

By 2030, the institutions may hold some 7.6 million homes, or more than 40% of all single-family rentals on the market, according to the 2022 forecast by MetLife Investment Management. Source

As is true in most things, it's complicated. PE buying houses in large numbers is not the sole cause of the housing crisis, but a contributing factor.

Banks gotta stop clawing back their $800B loss in corporate real estate by way of residential home buyers and car owners.

Kinda opening the door for a private equity enslavement of the citizenry.

Anyone that bought when rates were still 2-3% isn’t selling unless they’re being forced. Why would they, considering their real interest rate is negative at this point.

This is a non-headline because it’s reporting on something that was expected to happen when interest rates rose.

That being said, this does suck for those who have yet to purchase their first home. Property investors buying with cash have no incentive to stop buying. This is where government should step in and regulate. Those conversations should be headlining instead.

The buyer pressure was largely rental buyers, and they are completely out building up capital for a collapse. That’s my read on this.

So, buy now and have high interest rates, or wait til they drop and have to compete with dozens of other people, and pay 10-20k above asking?

Paying above asking will cost a lot less than an extra 4% over 30 years.

What if you just refinance when the rate drops

Overbidding at the start of a run up in prices is a lot less risky than overbidding at the top of the cycle.

Unfortunately it’s hard to tell where you are except in hindsight.

The latter. I can't house hunt if I can't afford to house hunt.

Nice burrito bro

Thank you so much

News

Welcome to the News community!

Rules:

1. Be civil

Attack the argument, not the person. No racism/sexism/bigotry. Good faith argumentation only. This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban. Do not respond to rule-breaking content; report it and move on.

2. All posts should contain a source (url) that is as reliable and unbiased as possible and must only contain one link.

Obvious right or left wing sources will be removed at the mods discretion. We have an actively updated blocklist, which you can see here: https://lemmy.world/post/2246130 if you feel like any website is missing, contact the mods. Supporting links can be added in comments or posted seperately but not to the post body.

3. No bots, spam or self-promotion.

Only approved bots, which follow the guidelines for bots set by the instance, are allowed.

4. Post titles should be the same as the article used as source.

Posts which titles don’t match the source won’t be removed, but the autoMod will notify you, and if your title misrepresents the original article, the post will be deleted. If the site changed their headline, the bot might still contact you, just ignore it, we won’t delete your post.

5. Only recent news is allowed.

Posts must be news from the most recent 30 days.

6. All posts must be news articles.

No opinion pieces, Listicles, editorials or celebrity gossip is allowed. All posts will be judged on a case-by-case basis.

7. No duplicate posts.

If a source you used was already posted by someone else, the autoMod will leave a message. Please remove your post if the autoMod is correct. If the post that matches your post is very old, we refer you to rule 5.

8. Misinformation is prohibited.

Misinformation / propaganda is strictly prohibited. Any comment or post containing or linking to misinformation will be removed. If you feel that your post has been removed in error, credible sources must be provided.

9. No link shorteners.

The auto mod will contact you if a link shortener is detected, please delete your post if they are right.

10. Don't copy entire article in your post body

For copyright reasons, you are not allowed to copy an entire article into your post body. This is an instance wide rule, that is strictly enforced in this community.